The difference is this capital can be used by the business to create capital employed or capital fixed assets. Capital employed is only capital that has been used in current assets and capital fixed assets. Capital employed is capital that has been invested by any company in order to help the business grow. The capital employed can also refer to the amount of capital used for a particular purpose. A number of different factors are involved when calculating capital employment. These include gross profits and the percentage return on the investment.

How Do You Calculate Capital Employed From a Company’s Balance Sheet?

This can help neutralize financial performance analysis for companies with significant debt. To calculate capital employed from the balance sheet, you must add the total value of both equity and long-term debt. Start by locating the balance sheet’s total equity, including common stock, retained earnings, and any additional paid-in capital.

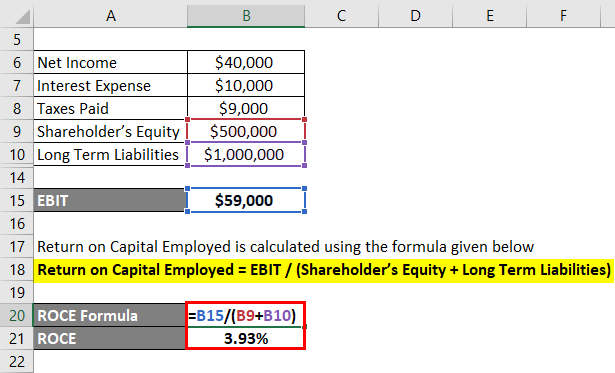

Formula and Calculation of Return on Capital Employed (ROCE)

Generally speaking, the higher a company’s return on capital employed (ROCE), the better off the company likely is with regard to generating long-term profits. Such ratios are essential because they include the influence of debt on the performance/profitability of the company. Otherwise, you can be biased with ratios such as ROE that only considers equity and not the effect of long-term liabilities. However, the results may not be meaningful because all the different operations and segments of a business would have different assets. You could find that even within a single company, roce may not mean much for one division if it is only $5 million in net income but $50 million in capital employed. John Trading Concern has a 32.81% return on its total capital employed in the business.

Capital Employed Calculation Example

Capital employed refers to the total long-term funds at the disposal of the company (i.e., the sum of equity, preference share capital, and long-term loans). However, it is better (though in practice perhaps unnecessary) to use the average capital employed throughout the year. To obtain this, you need at least the opening and closing balance sheets. Normally, annual profit is compared to capital employed, as shown in the balance sheet at the end of the year. The return on capital employed indicates how the management has used the funds supplied by creditors and owners. This ratio aims to show how well a company has used its total long-term funds.

It is an operational current liability and needs to be deducted to calculate the working capital. However, it has not employed the entire amount in the operational business. It reports a cash balance of 20, which is deposited in a bank and not part of the company’s operations. This is an example of idle capital and is not included in the company’s capital employed calculation. This leaves 130 invested in operational assets such as working capital, PP&E, or any other operational asset less operational liability the business needs to operate.

Can ROCE ratio be used to compare different companies in the same industry?

A higher ROCE suggests better utilization of capital and higher profitability. This figure represents the amount of capital invested in the company to generate profits and operate the business effectively. However, limitations exist, such as not accounting for cash flow timing and challenges in comparing ROCE across different industries due to varying capital intensity levels.

- The figure is commonly used in the Return on Capital Employed (ROCE) ratio to measure a company’s profitability and efficiency of capital use.

- This figure is used in financial analysis to evaluate a company’s financial performance and efficiency in generating returns from its capital investment.

- A higher ROCE indicates a more efficient company with more successful capital investments.

- The return on capital employed shows how much operating income is generated for each dollar of capital invested.

- For example, if there are no long-term liabilities, this means 100% of liabilities are current.

The next step is to calculate the capital employed, which is equal to total assets minus current liabilities. Some analysts will use net operating profit in place of earnings before interest and taxes when calculating the return on capital employed. This is because, unlike other fundamentals such as return on equity (ROE), which only analyzes profitability related to a company’s shareholders’ equity, ROCE considers debt and equity.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, fake turbotax discount through vanguard and fidelity except where prohibited by law for our mortgage, home equity and other home lending products. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

The average ROCE of a cybersecurity company is not the same as the average ROCE of a steel mill company. Of course, the second one is much more capital intensive (more capital employed) and will have more depreciation in their assets (less EBIT). The reason why we use an average for year-end is because we do not want to allow a high level of debt at the start to have us pay interest on that money before it becomes capital employed. So, you need to net out your first day’s debt from your first day’s equity. However, if capital employed at the beginning of the year is unknown or cannot be determined from the available data, it is not uncommon to use only the year-end figures to calculate capital employed.